Table of Contents

About Fxify

When it comes to prop trading firms, Fxify stands out as an innovative player in the financial markets. This comprehensive Fxify Review aims to shed light on what sets the platform apart. Founded by a team of seasoned traders—David Bhidey, Peter Brown, and Robert Winters—Fxify brings over 30 years of collective trading and brokerage experience to the table. These industry veterans have traded with renowned prop firms and are now channeling their expertise into Fxify, offering traders unparalleled opportunities.

Fxify is not just another trading firm; it’s a platform designed to elevate your trading experience. With real-time analytics and metrics, traders can enhance their strategies and make informed decisions. One of the firm’s standout features is its ability to offer up to $4,000,000 in trading capital, a figure that is sure to catch the eye of both novice and experienced traders alike.

What truly distinguishes Fxify is its focus on customization. Whether you’re an aggressive trader or someone who prefers a more flexible approach, Fxify has got you covered. The firm offers two tailored evaluation programs: the 1-phase and 2-phase evaluations. These programs are designed to accommodate traders with varying skill levels and risk tolerance, providing a straightforward path to financial success.

But that’s not all. Fxify goes the extra mile by offering a supportive and transparent trading environment. The platform has a friendly community that assists traders in navigating the complexities of financial markets. This is particularly beneficial for those who are new to trading and could use some guidance.

Moreover, Fxify offers flexible options to optimize your trading account. You can choose your initial starting capital, increase your leverage, extend your evaluation period, and even opt for bi-weekly payouts. These features are designed to help traders reach their full earning potential, making Fxify a firm that truly understands the needs and challenges of modern-day trading.

In summary, Fxify is more than just a prop trading firm; it’s a platform that empowers traders to achieve their financial goals through advanced tools, extensive support, and customizable options.

Fxify Review

If you’re a trader looking for a platform that offers not just substantial trading capital but also a plethora of advanced features, then Fxify might just be the solution you’ve been searching for.

In this review, we’ll explore everything from Fxify’s unique evaluation programs to its flexible trading rules and extensive range of tradable assets. Whether you’re a seasoned trader or a newcomer to the financial markets, Fxify offers something for everyone. With up to $400,000 in trading capital and a community that supports your trading journey, this platform is designed to help you achieve your financial goals.

So, if you’re interested in finding out whether Fxify is the right fit for you, keep reading. We’ll cover all aspects, including fees, tradable assets, and even how to make the most of a Fxify discount code. Let’s get started!

Funding Program Options

Continuing our comprehensive Fxify Review, let’s delve deeper into the One Phase and Two Phase programs offered by Fxify. These programs are designed to cater to traders with varying levels of experience and risk tolerance.

The One Phase Program

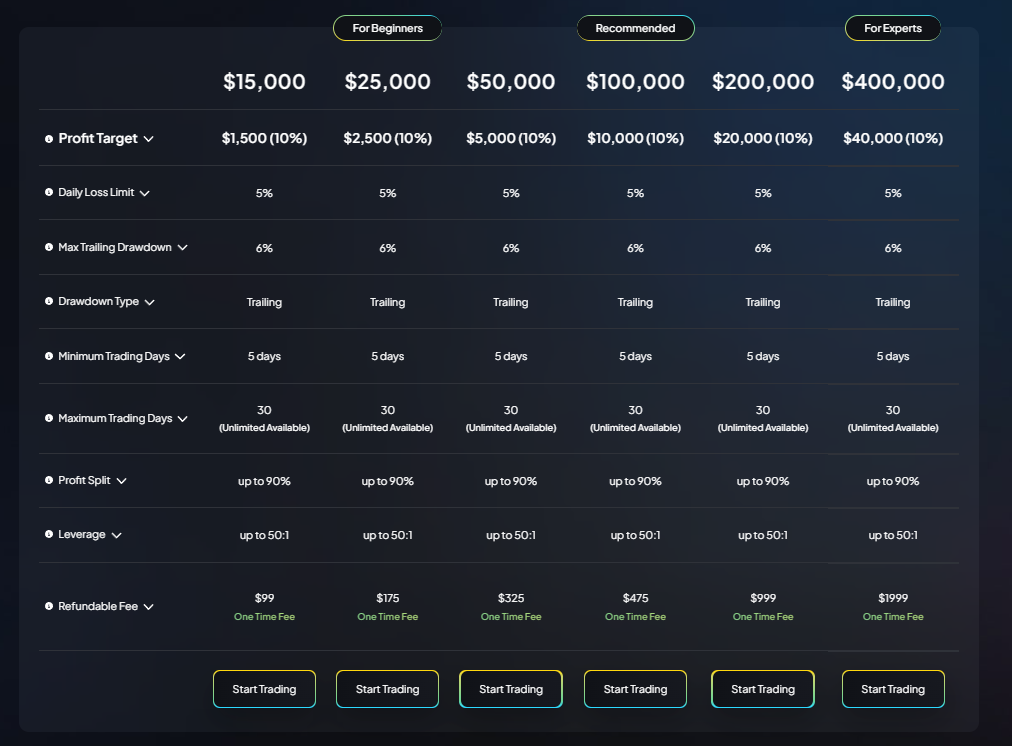

If you’re a trader eager to quickly access a funded account, the One Phase Program is tailored for you. This program only requires you to complete a single evaluation phase to qualify for funding. Designed to favor low-risk trading strategies, it increases your likelihood of successfully passing the evaluation. Once you clear this phase, you can leverage Fxify’s scaling plan to grow your account balance, potentially all the way up to $4,000,000.

In this program, the maximum trailing drawdown is limited to 6%, requiring traders to manage their positions carefully. A minimum commitment of five trading days is needed, providing a focused window to showcase your trading skills. The program also offers a generous profit split of up to 90% and allows leverage up to 50:1, enabling traders to control larger positions with a smaller capital outlay.

The Two Phase Program

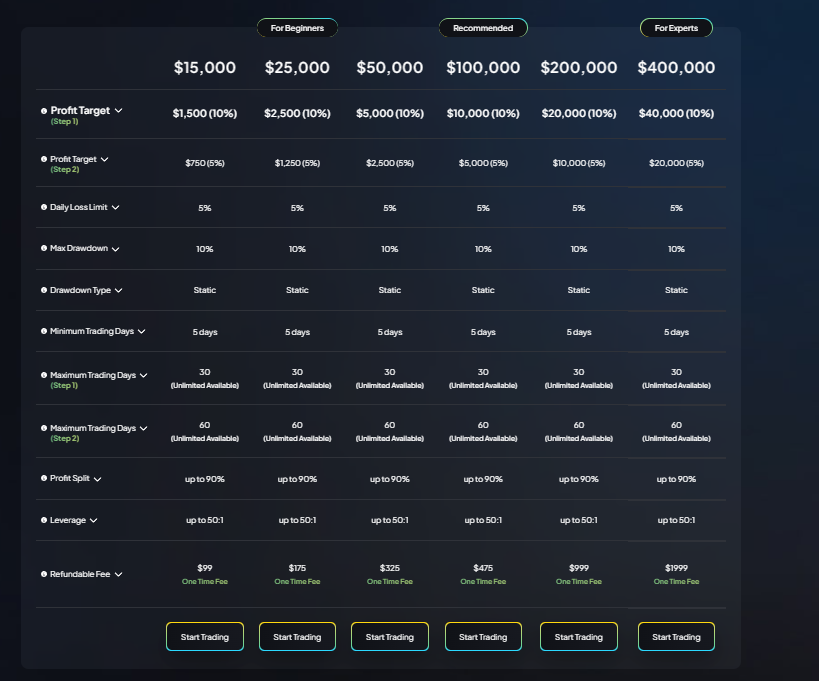

For those who prefer a more structured approach, the Two Phase Program is an excellent fit. This program involves a two-step evaluation process and offers initial starting capital that ranges from $25,000 to $400,000. The goal is to identify committed Forex Prop Firm traders who demonstrate essential trading skills such as consistency, accuracy, and effective risk management.

In this program, traders must adhere to a maximum drawdown of 10% throughout both phases. A minimum of five trading days is also required for each phase, but the second phase offers a different timeframe, giving traders more flexibility. Just like the One Phase Program, the Two Phase Program also offers a profit split of up to 90% and maintains a consistent leverage of up to 50:1.

Fxify understands that every trader has unique needs and preferences. That’s why they offer a variety of account options, each with its own set of features and benefits, including an industry-leading trading dashboard and customizable account settings. Whether you’re a beginner or an expert, Fxify has an account that will align with your trading style and objectives.

While we won’t delve into the specifics of the fees in this section, it’s important to note that all fees are refundable. This offers an extra layer of assurance and peace of mind as you embark on your trading journey with Fxify.

Fees

Navigating the financial landscape of trading can often be complicated, but Fxify aims to make it as straightforward as possible. One of the most reassuring aspects of their funding programs is the fee structure. While we won’t go into the nitty-gritty details, it’s important to know that the fees for both the One Phase and Two Phase programs are refundable. The fees range from a one-time payment of $99 to $1,999, depending on the account size and program you choose. This refundable fee structure offers traders an extra layer of financial security, allowing you to focus more on your trading and less on the costs involved.

Tradable Assets

When it comes to trading platforms, Fxify offers the flexibility of using either MetaTrader 4 (MT4) or MetaTrader 5 (MT5), both of which are supported by a top-tier, multi-asset, Tier 1 true STP broker. This ensures that traders have an optimal environment for executing their trades. But what truly sets Fxify apart is the extensive range of trading instruments available. With over 300 options to choose from, traders have the freedom to diversify their portfolios across various markets, including stocks, cryptocurrencies, indices, and forex.

One of the standout features of Fxify is its commission-free trading options for forex, gold/metals, and indices. This allows traders to optimize their performance by cutting down on the additional costs usually associated with these asset classes. So, whether you’re looking to trade traditional forex pairs or venture into the realms of cryptocurrencies and stocks, Fxify provides a comprehensive platform that caters to a wide array of trading preferences.

Restrictions

One of the most appealing aspects of Fxify is its relaxed trading rules, which set it apart from many other prop trading firms. For starters, Fxify supports the use of Expert Advisors (EAs), allowing traders to automate their strategies and enhance their trading experience. This technological support can be a significant advantage for those looking to optimize their trading outcomes.

Another noteworthy feature is the ability to hold trades open over the weekend. While some prop firms restrict this, Fxify offers the flexibility to manage your positions according to your own trading style and preferences. This can be particularly beneficial for traders who employ strategies that require holding positions for extended periods.

Moreover, Fxify does not impose any consistency rules, meaning you can trade at your own pace without being bound by specific requirements. This freedom can be especially attractive for traders who prefer to adapt their strategies to varying market conditions.

Lastly, Fxify does not require traders to set a stop loss for their trades. This gives you greater control over your risk management strategies, allowing you to make decisions based on your own judgment and analysis. In summary, Fxify’s relaxed trading rules make it an ideal choice for traders seeking a flexible and accommodating trading environment.

Challenge

When it comes to challenges, Fxify offers a unique approach through its One Phase and Two Phase programs. These programs serve as an evaluation process where traders can showcase their skills and earn significant profits using Fxify’s capital. The One Phase program is particularly suitable for traders looking to quickly access a funded account. It requires traders to complete just one evaluation phase, which is tailored to low-risk trading strategies. The aim is to reach a 10% profit target within a set period, without exceeding a maximum trailing drawdown of 6%.

On the other hand, the Two Phase program offers a more structured evaluation process. It starts with an initial assessment where traders aim to achieve a 10% profit target. Upon successful completion, traders move on to a second verification stage. This two-step process allows Fxify to identify traders who exhibit discipline, focus, and consistent profitability in financial markets.

Both programs have their own set of rules regarding drawdown, minimum trading days, profit split, and leverage, offering traders a comprehensive yet flexible environment to prove their trading prowess. The challenge lies in adhering to these rules while striving to meet the profit targets, all of which makes Fxify’s funding programs not just an opportunity but a rewarding challenge for traders of all levels.

Fxify Coupon Code

If you’ve made it this far in our Fxify Review and are considering giving Fxify a try, we have some good news for you. You can register through this special link to receive exclusive discounts from Fxify. This is a fantastic opportunity to start your trading journey with Fxify at a reduced cost, making it even more appealing for both new and experienced traders.

Whether you’re interested in the One Phase or Two Phase funding programs, or you’re keen to explore the wide range of tradable assets, this special link offers a cost-effective way to access all that Fxify has to offer. Don’t miss out on this chance to optimize your trading experience with Fxify.

Conclusion

In this comprehensive Fxify Review, we’ve explored the various facets that make Fxify a compelling choice for traders seeking a flexible yet structured trading environment. From its innovative One Phase and Two Phase funding programs to its relaxed trading rules, Fxify offers a unique blend of features designed to cater to traders of all experience levels.

Whether you’re a seasoned trader or a newcomer to the financial markets, this Fxify Review has shown that the platform provides the tools, support, and freedom you need to succeed. The platform’s support for Expert Advisors, absence of consistency rules, and the option to hold trades over the weekend are just a few of the features that set it apart from other prop trading firms. Add to this the wide range of tradable assets and commission-free trading options, and it’s clear that Fxify is committed to providing an optimal trading experience.

In summary, if you’re looking for a prop trading firm that offers a balanced mix of flexibility and structure, along with a supportive community and customizable options, Fxify should be at the top of your list.

The Review

Fxify Review

In this Fxify Review, we've taken a comprehensive look at what makes Fxify a compelling choice for traders. With its flexible One Phase and Two Phase funding programs, a wide array of tradable assets, and relaxed trading rules, Fxify stands out as a prop trading firm that caters to both novice and experienced traders. While it offers many advantages such as commission-free trading and support for Expert Advisors, potential users should also consider factors like drawdown limits and minimum trading days. Overall, Fxify offers a balanced mix of features designed to help traders succeed in the financial markets.

PROS

- Offers both One Phase and Two Phase funding programs to suit different trading styles.

- Wide range of tradable assets including stocks, cryptocurrencies, and forex.

- Relaxed trading rules, including no consistency requirements and the option to hold trades over the weekend.

- Commission-free trading options for forex, gold/metals, and indices.

- Support for Expert Advisors (EAs) to automate trading strategies.

CONS

- The maximum drawdown limits may not suit all trading strategies.

- Minimum trading days requirement could be restrictive for some traders.

- No mention of a demo or trial period for new users to test the platform.

- The two-phase program might be complex for beginners.

- Leverage up to 50:1 could be risky for inexperienced traders.

Review Breakdown

-

Funding Program Options

-

Fees

-

Tradable Assets

-

Restrictions

-

Challenge